A. BIR 등록을 위한 구비서류 및 절차(법인 및 파트너쉽)

일반적으로 법인설립은 SEC 등록 --> Business Permit --> BIR 등록 순으로 진행하는 것이 매끄럽다. 하지만 본인의 경우 이런 순서로 하나씩 진행하다가 BIR 등록단계에서 기한도과로 벌금을 내야했다. 따라서 법인설립을 마쳐 SEC 등록증을 받게 되면 Business Permit와 BIR 등록을 같이 진행하는 것이 좋을 듯 하다.

각 세무소들은 고객지원센터를 두고서 납세자들의 서류작성 및 절차를 도와주고 있다. 해당 RDO 사무실에 들어서면 "Officer of the Day"이라고 씌여진 곳을 찾아 민원담당자에게 도움을 청하자.

1. 관할세무소(Revenue District Office, RDO)

만약 관할세무소가 어딘지 모른다면? 이웃가게의 관할세무소 역시 나와 같을테니까 이웃가게에게 물어보는 것이 가장 빠르다. 아니면 바랑가이 명칭이나 municipality 명칭을 이용해 BIR 홈페이지에서 직접 찾을 수도 있다(

http://www.bir.gov.ph/directory/rdo.htm). 이웃집 등록증(Certificate of Registration)의 상단에 보면 "Revenue District No. ***"가 적혀있다. 이것이 관할세무소 고유번호이다.

2. 등록 신청 기한

- BIR 등록(application for registration)은 자신의 영업을 개시하기 전에 등록하는 것이 원칙이고 늦어도 첫번째 세금납부 기한까지는 등록하여야 한다. 영업을 시작한 그 달부터 세금을 내야한다.

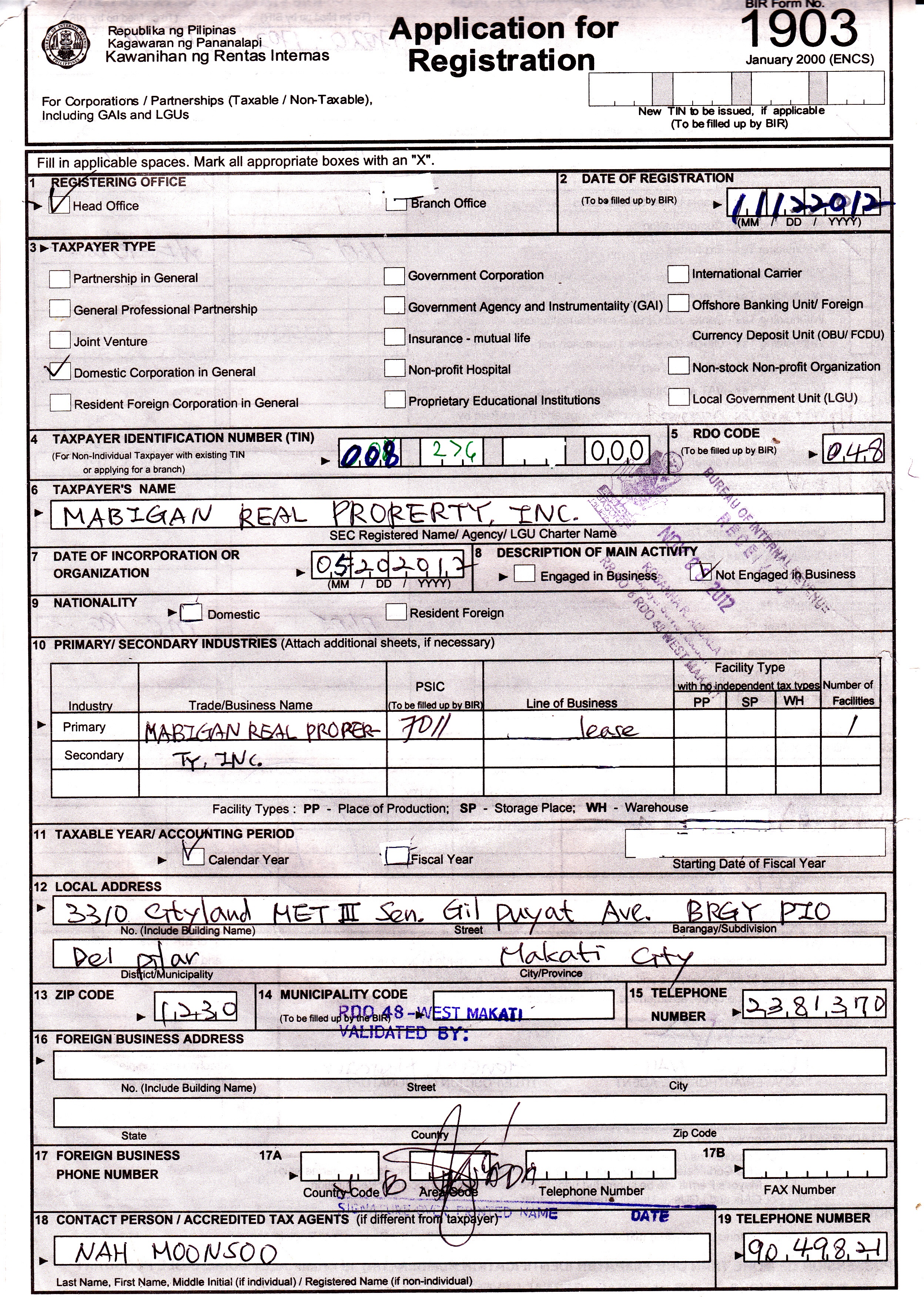

3. 등록신청서(Application for Registration) 작성

법인/파트너쉽의 경우 등록신청서 양식번호(BIR Form No.)는 1903이며 개인사업자(self-employed)의 경우에는 1901이다. (BIR 양식은 BIR 홈페이지에서 출력할 수도 있고 세무소 입구에서 경비원이 나누어주기도 한다.)

아래의 신청서 견본을 참조하면서 위에서부터 차례대로 작성방법을 설명하기로 한다. 불필요한 항목이나 BIR 담당자가 기재하는 항목은 설명을 생략한다.

- 1. Registration office : 주사무소이면 "Head office"에 분사무소/지점이면 "Branch office"에 표시

- 3. Taxpayer Type : 일반적인 법인이라면 "Domestic Corporation in General"에 체크, foundation과 같은 비영리-비주식회사라면 "Non-stock Non-profit organization"에 체크한다.

- 4. Taxpayer Identification Number : SEC 등록증(Certificate of Incorporation) 좌측상단에 보면 COMPANY TIN이 기재되어 있다. 이 번호를 기재한다.

- 6. Taxpayer's name : SEC에 등록된 법인명을 기재한다.

- 7. Date of Incorporation or organization : SEC 등록증 아래 쪽 " IN WITNESS WHEREOF"로 시작하는 부분에 보면 법인발기일이 기재되어 있다. 이 날짜를 적는다.

- 8. Description of main activity : 영업활동을 하는 경우에는 "Engage in Business"에 체크, 파운데이션과 같이 친목, 자선 등을 행하는 경우에는 "Not Engage in Business"에 체크한다.

- 9. 외국에 본점을 둔 외국계회사라면 "Resident foreign"에 체크, 아니면 "Domestic"에 체크한다.

- 10. Primary/Secondary industries : 법인명과는 다른 상호를 사용한다면 그것을 Trade/Businessname에 기재한다. 법인정관에 기재된 "purpose of company"를 Line of business에 간략하게 기재한다. Number of facilities에는 영업에 이용되는 건물의 갯수를 기재한다. (공장-PP, 야적장-SP, 창고-WH)

- 11. Taxable year/accounting period : 회계년도기간을 정하는 난이다. 달력에 따라 1월 1일부터 12월 30일까지를 회계년도기간으로 하고자 하는 경우에는 "Calendar year"에 체크, 이와 다른 기간을 정한 경우에는 "Fiscal year"에 체크하고 "Starting Date of fiscal year"에 회계년도 시작일을 기재한다. 장단점이 있지만 Calendar year를 선택하는 것이 무난하다.

- 12. Local address : 사무소/영업소의 주소

- 13. ZIP CODE : 사무소/영업소 우편번호

- 15. Telephone Number : 사무소/영업소 전화번호

- 18. Contact person, Telephone number : 법인을 대표해 연락 가능한 사람의 성명과 연락처 기재한다.

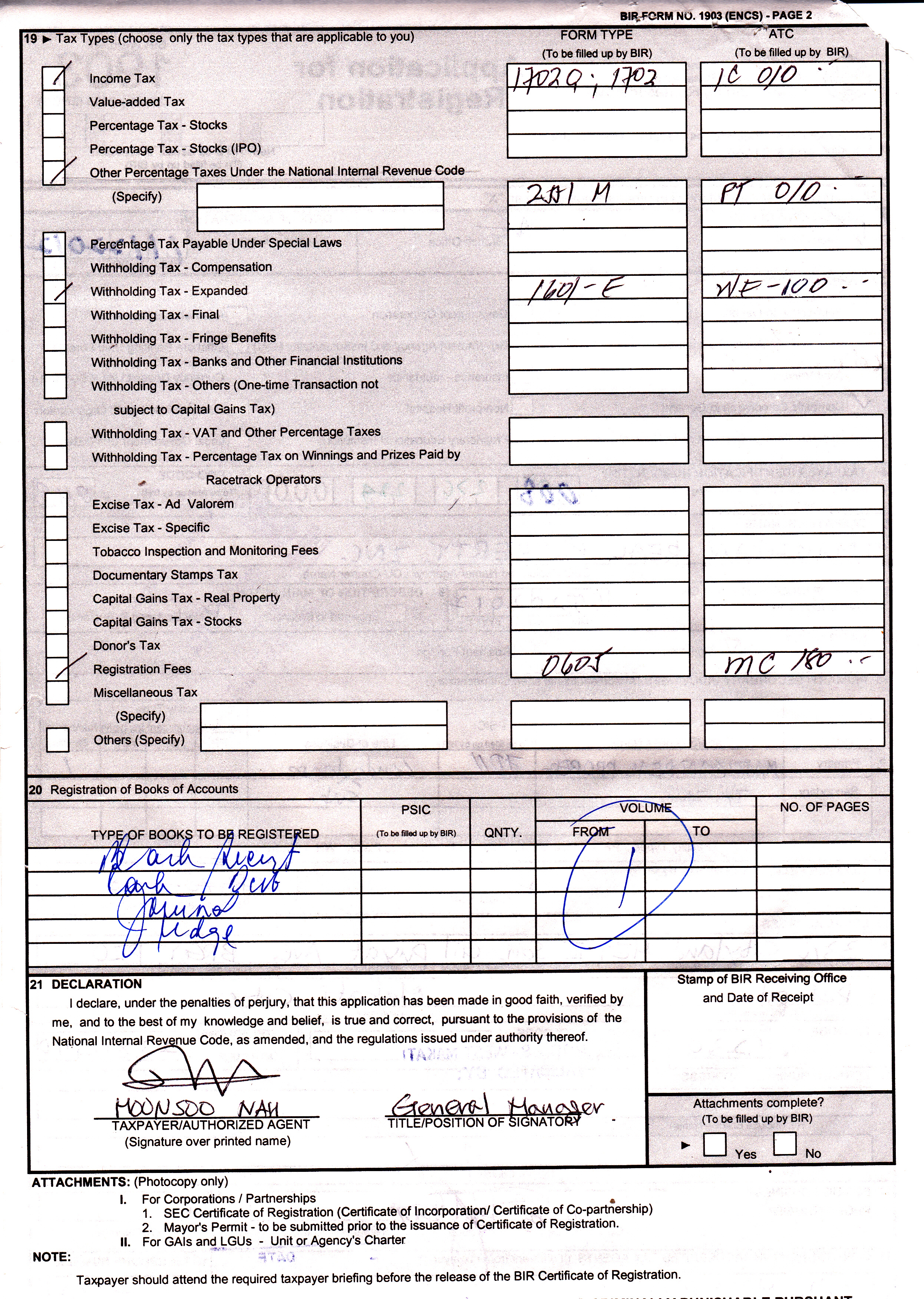

- 19. Tax types

BIR담당자가 기재하는 난이다. 하지만 이 부분이 가장 중요한 부분이다. 앞으로 납부해야할 세금의 종류를 표시하는 란이다. 세금의 종류는 정관에 기재된 법인목적(purpose of company)을 참조하여 BIR담당자가 정한다. 이 경우를 대비해 법인정관의 목적을 잘 적어야 한다. 일단 필수적인 영업목적만 간략하게 적고 BIR 등록 후에 정관을 정정해서 법인목적을 확장하면 된다.

- 20. Registration of books of accounts

기장(Book keeping)해야 할 회계장부들을 적는 란이다. 일반적으로 Ledger, Journal, Cash Receipt, Cash Distribution 등 4가지를 포함한다. 문방구에서 "Books of accounts"로 쓸 것이라고 말하고 구입한다. BIR에서 확인도장을 찍어준다

- 21. DECLRATION

납세자/대리인(TAXPAYER/AGNET)이 등록신청을 함에 있어 악의나 거짓이 없음을 선언하고 위반시 위증죄에 따라 처벌받겠다는 선언서이다. 인쇄체로 이름을 적고 그 위에 서명한다. 그리고 회사 내 직책(TITLE/POSITION)을 기재한다.

Attachments(구비서류)

- SEC 등록증 사본 (SEC Certificat of Incorporation/Co-partnership)

- Business/Mayor's Permit 사본(BIR 등록 신청 당시 Business Permit을 신청을 하였으나 발급은 받지 못한 상태라면 일단 시청에 제출한 Business Permit 신청서 사본을 대신 BIR에 제출한다. 그리고 BIR 등록증이 발급되기 전까지만 Business Permit을 제출하면 된다.)

4. 비용 납부

BIR 담당자가 등록신청서를 검토한 후, 추가로 Payment Form (BIR Form 0605)를 적어주면서 등록료를 먼저 납부하고 오라고 할 것이다. (19. Basic Tax는 500페소이다.)

Payment form 3부를 들고 수납대행은행(AAB)으로 향한다. 은행 경비원에게서 BIR TAX PAYMENT DEPOSIT SLIP을 받아 작성한다. 아래 사진에서 보듯이 Tax type에는 RF, Tax Form은 0605라고 기재한다. 수납대행은행을 통한 세금납부절차는 따로 자세히 설명하기로 한다.

B. 이 밖에도 BIR 등록시 함께 납부하는 세금이 있다.

- 주식에 대한 인지세(Documentary Stamp Tax) 납부

주식회사를 설립하는 경우 주식을 발행하게 되는데 이 주식에 대해서도 인지세를 내야 한다. 세액은 출자액(Subscribed Stock)의 200분의 1이다.

- 만약 점포/사무소를 임대한 경우에는 임대계약서에 대한 인지세 납부하여야 한다. 인지세를 정하는 과세기준(tax base)는 계약기간 중 총 임차료, 보증금(deposit) 및 선금(advance rent)을 합한 금액이다. 이 합계의 처음 2,000페소까지는 3페소, 그리고 다시 1,000페소를 추가할 때 마다 1페소를 추가한다.

- 양식은 BIR Form 1906이다. 기한은 주식을 발행한 날 또는 계약서를 작성한 날이 속하는 달의 다음달 5일 이전까지 신고하여야 한다.

C. BIR 등록시 함께 해야 할 일

다음의 2가지는 BIR 등록 신청과 함께 또는 등록일로부터 30일 이내에 하여야 한다.

- BIR 등록신청서 제출 후 등록증(Certificate Of Registration, COR)을 받기 전에 세미나(seminar)에 한 번 참석하여야 한다. Makati West Office의 경우에는 매주 수요일 13:30에 예정되어 있다. 세미나라고 해서 별건 아니고 그날 참석자 2~3명이 담당자 책상 주변에 모여 앉아 세금에 관한 기본적인 사항을 설명받는 것이다. 형식적인 절차이다.

- 영수증/송장 인쇄허가 신청서(application for Authority to Print invoices/receipts)를 제출하여야 한다(BIR Form 1906). 그 구체적인 방법에 대해서는 따로 설명하기로 한다.

- 회계장부 구입

만약 앞의 3-20처럼 BIR 등록시에 회계장부를 등록하지 못했다면 BIR 등록 후 30일 이내에 회계장부를 등록하여야 한다. 회계장부를 구입한 후 BIR Form 1905과 함께 제출한다. 회계장부를 다 사용했을 때는 아무 때나 새로운 장부를 BIR에 등록할 수 있다. 다 사용하지 않았더라도 매년 12월달에 새로운 회계장부를 등록할 수 있다. 만약 기존의 장부에 여유가 있어 다음 해에도 계속해서 사용하고 싶다면 12월에 BIR에 제시하고 확인도장을 받아야 한다.

D. 참고로 BIR 등록을 한 달부터 세금신고를 해야한다. 자신의 등록증에 기재된 세금의 종류를 살펴 아직 신고기한이 지나지 않은 세금에 대해서는 그 달부터 납부하도록 하자.

MRPI (2013/09/20)