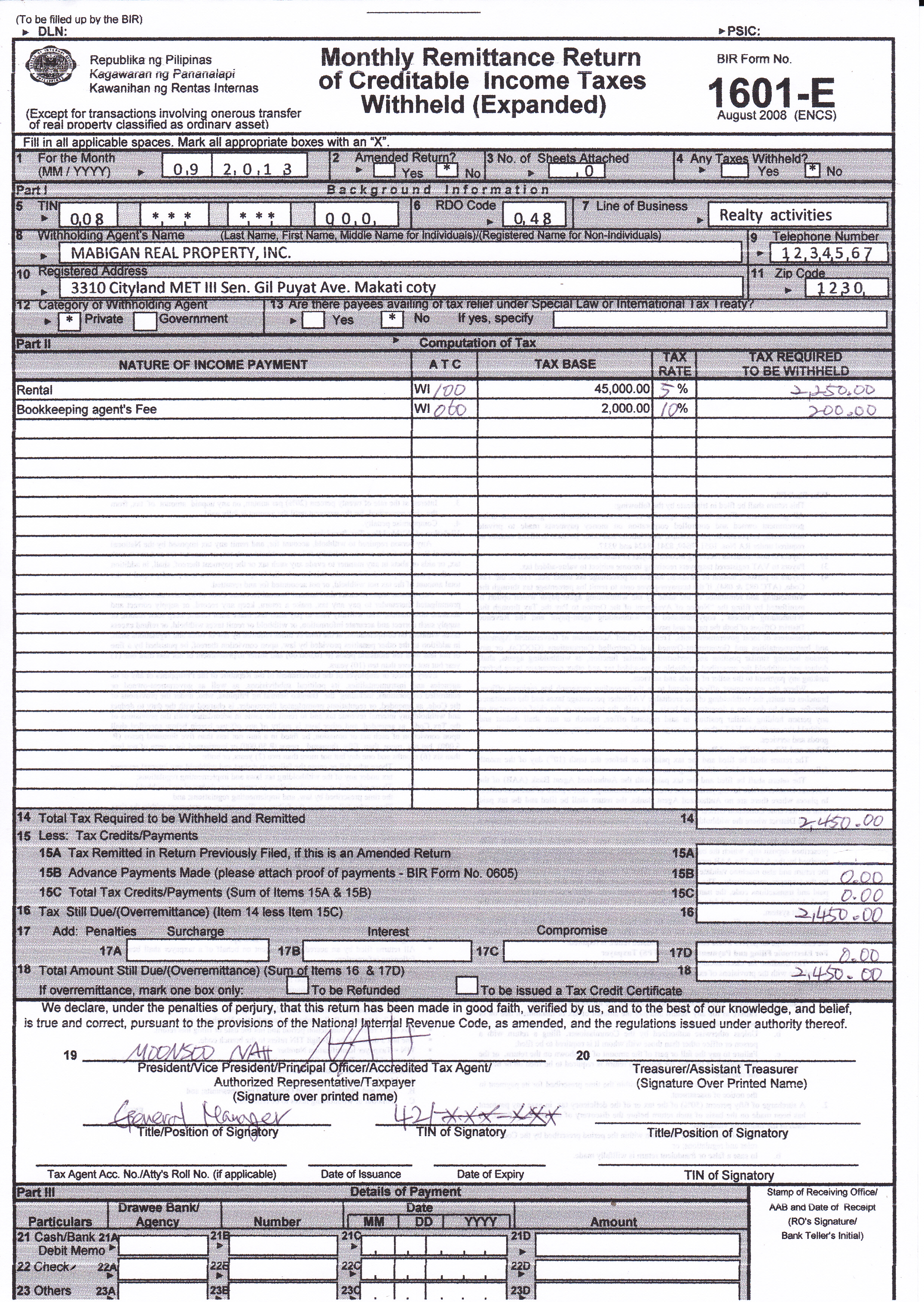

Withholding Tax-Expanded 신고하기(BIR Form 1601E)

WTE는 원천징수세의 일종이다. 또 다른 원천징수세인 Withholding Tax-Compensation은 고용주가 피고용자에게 지급하는 급여에 대한 세금인 반면 WTE는 급여 이외에 제 3자에게 지급하는 보수에 대한 세금인 것이다. 대표적인 예로 건물임차료를 들 수 있다. 임차인은 임대인에게 매달 임차료를 지불하기에 앞서 임차료 중 5%에 해당하는 금액을 떼어 놓았다가 BIR에 대신 납부하여야 한다. 임대인(payee)의 소득에 대한 세금이지만 임차인(payor, withholding agent)이 대신 제출하여야 의무를 진다. WTE를 신고해야하는 소득들의 예가 BIR Form 1601E의 뒷면에 열거되어 있다.

BIR Form 1601E 작성하기

1) 항목 1에는 과세기간, 즉 세금이 발생한 달을 적는다. 예를 들어 2013년 9월치 세금이면 "09/2013"라고 기재한다.

2) 항목 2에는 "No"에 체크한다. 다만 먼저 제출한 세금신고서의 오류를 정정하기 위해 다시 제출하는 것이라면 "Yes"에 체크한다.

3) 항목 3에는 "0"으로 기재한다. 단, 지면이 부족해 별지를 추가하는 경우에는 그 숫자를 기재한다.

4) 항목 4는 "Yes"에 체크한다. 단, 이번 달에 낼(withhold) 세금이 없다면 "No"에 체크한다. 달리 말해, 항목 16이 0 또는 음수(overpayment)가 되면 "No"에 체크한다.

5) 항목 5 내지 11은 BIR 등록증(Certificate of Registration) 등을 참조하여 기재한다.

6) 항목 12 : "Private"에 체크한다.

7) 항목 13에는 "No"에 체크한다. 단, 경제자유구역(ECOZONE)에 입주한 기업체와 같이 세금 감면 혜택을 받는 업체라면 "Yes"에 체크한다. 그리고 관련 법령 번호를 기재한다.

8) Part II. Computation of Tax

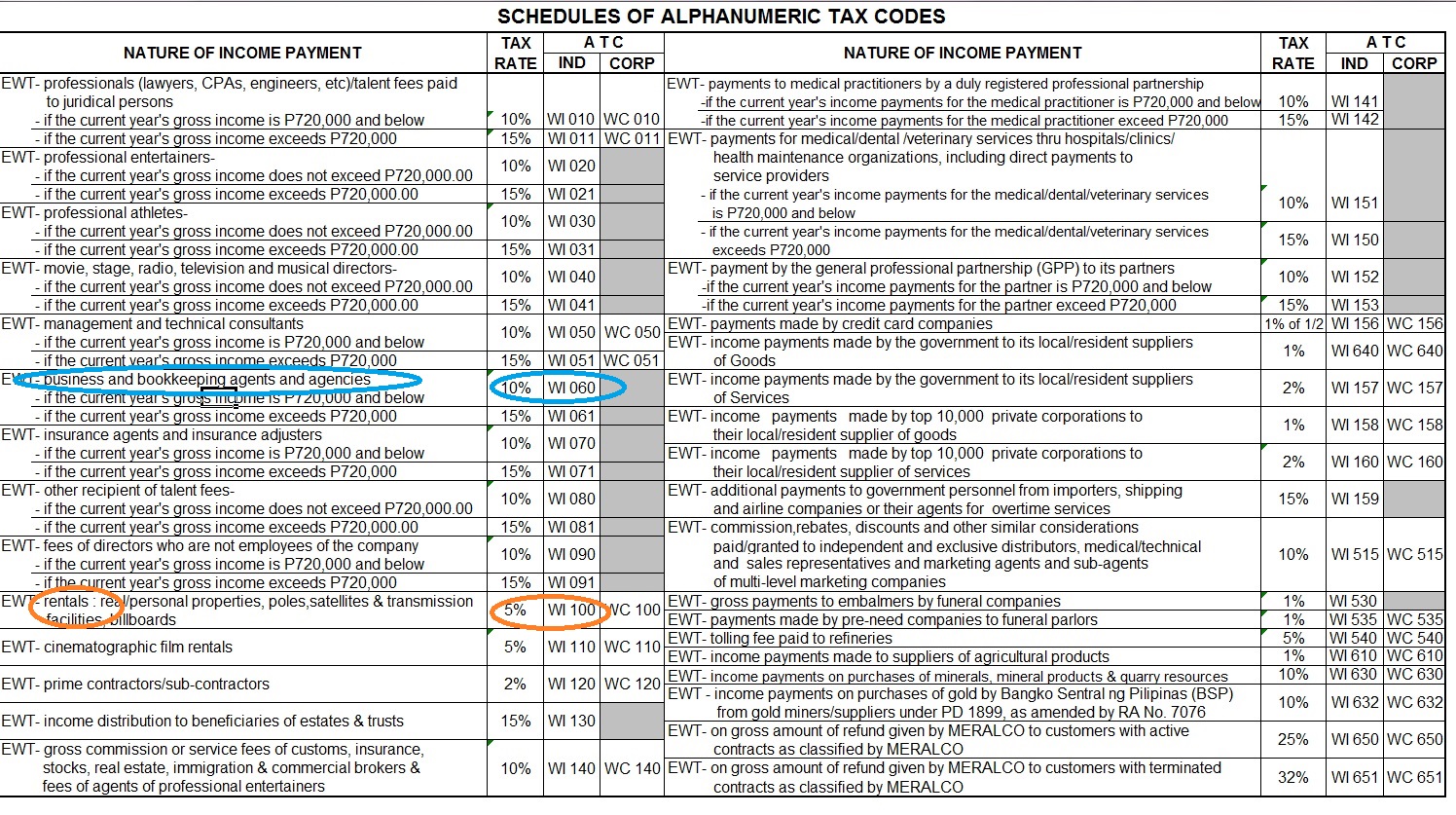

- "Nature of income payment"에는 소득의 명칭을 기재한다. 양식 뒷면의 Schedule을 참조하여 적당히 적도록 한다. 첨부한 신고서는 임차료(rental)와 회계장부기장에 대한 수수료(Bookkeeping agent's Fee)를 포함하고 있다.

- "ATC" : 양식 뒷면을 보면 소득의 종류별로 ATC가 표시되어 있다. 가령 Rental의 경우에는 WI100이다. 임대인이 개인(Individual)이라고 가정한다.

- "Tax Base" : Rental의 경우에는 임차료가 Tax Base가 된다. 45,000페소라고 가정하자.

- "Tax Rate" : 양식 뒷면을 보면 5%라고 되어있다.

- "Tax required to be withheld" : Tax Base에 Tax Rate을 곱하면 2,250페소가 나온다.

9) 항목 14에는 앞에서 구한 세금들의 합계를 기재한다.

10) 항목 15에는 세액공제 받을 항목들을 기재한다.

- 15A. : 만약 세금 중 일부를 누락하고 세금신고한 경우에는 정정신고서를 제출할 수 있다. 이때는 먼저 낸 세금은 빼고 누락된 부분만 납부하면 된다. 따라서 여기엔 처음에 납부한 세금액수를 기재한다.

- 15B. Advance Payments made(BIR Form 0605) : 모르겠음.

- 15C. : 15A와 15B의 합계를 기재한다.

11) 항목 16에는 세액공제하고 남은 세금, 즉 14에서 15C를 뺀 액수를 기재한다. 만약 이때 잔액이 음수이면 초과납부(overremittance)된 것이다. 이때는 액수 앞에 "마이너스(-)"를 붙이는 것이 아니고 "괄호( )"로서 표시한다.

12) 항목 17 : 만약 세금을 연체하였다면 페널티를 물어야 한다. 페널티 계산방법에 대해서는 이미 설명한 바 있다.

13) 항목 18 : 세금(16)에 페널티(17D)를 마저 더해서 최종적으로 납부할 세금을 구한다. 만약 이때 overremittance가 발생하였다면 환불받을 수 있다. 만약 현금으로 돌려 받고 싶다면 "Te be Refunded"에 체크하고, 확인증을 받아두었다가 나중에 다른 세금낼 때 세액공제 받고 싶다면 "To be issued a Tax Credit Certificate"에 체크한다.

14) 항목 19에 세금을 납부하는 자의 성명을 쓰고 서명한다. 그 아래에는 직책(title/position)과 TIN을 기재한다.

<참고>

현실적으로는 많은 임차인들이 임대차계약서에서 정한 임차료를 모두 임대인에게 지불하고 따로 세금은 내지 않고 있다. 그런데 억울하게도 나중에 문제가 생기면 세금 불납에 대한 책임은 임차인이 져야 한다. 그러므로 계약시에 임차료에 WTE가 포함되는지를 물어, 포함된다면 임대인이 WTE를 납부할 책임을 지는 것으로 계약서에 명시하여야 한다.

MRPI (2013/09/23)