VAT 신고하기 제 2편- 정식기재

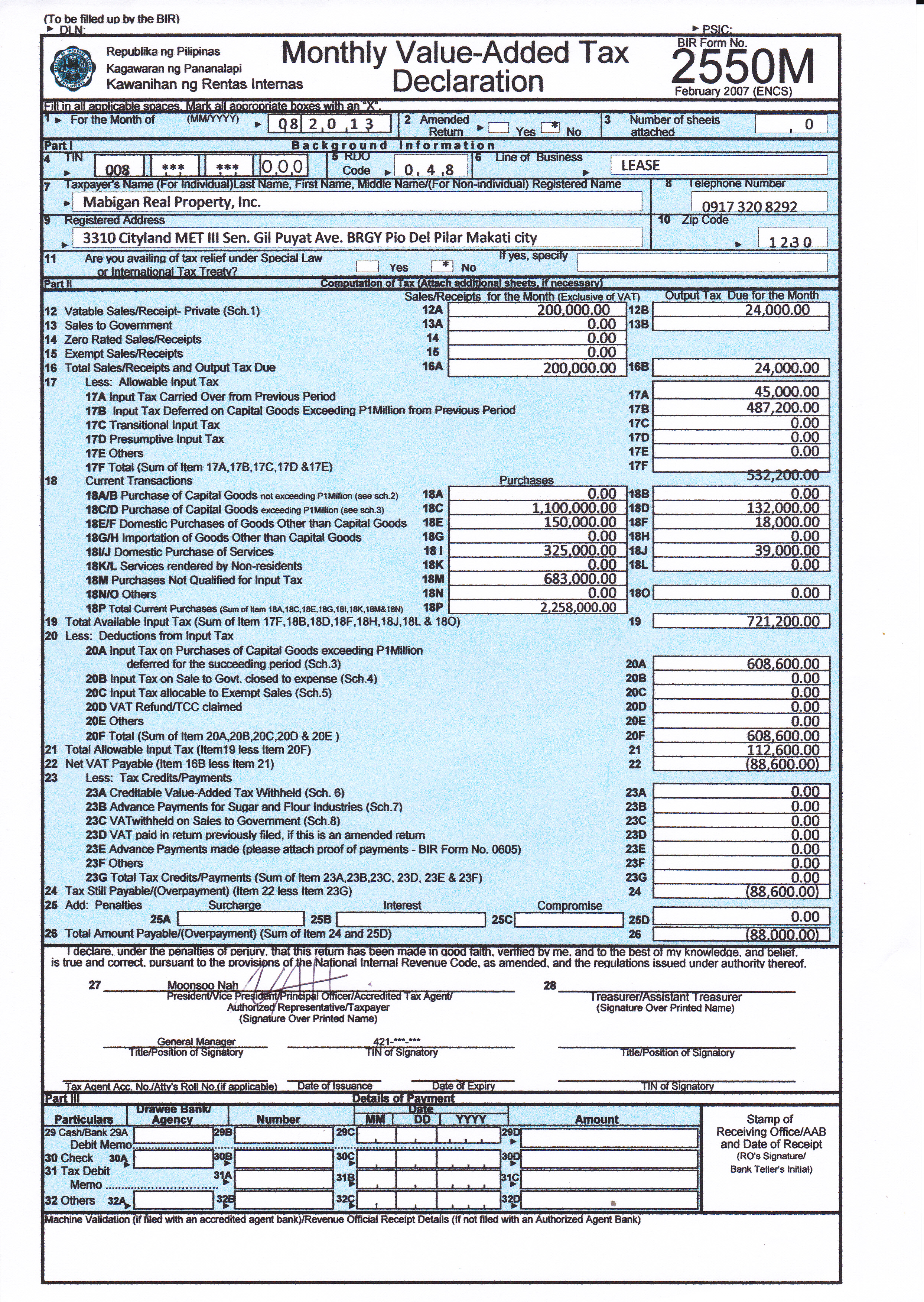

오늘은 부가가치세 신고서(Monthly VAT Declaration ; 2550M)의 모든 항목들을 빠짐 없이 제대로 작성하는 방법을 설명하고자 한다. 즉 "VAT 신고하기 제 1편-약식 기재"의 심화학습편이 되는 것이다. 이 글을 읽기 전에 먼저 "제 1편"을 읽어보기 바란다.

먼저 순부가가치세(Net VAT)의 개념에 대해 복습하자. Net VAT은 Output VAT으로부터 Input VAT을 차감함으로써 얻게된다(Net VAT=Input VAT-Output VAT). Output Tax은 내가 물건/서비스를 판매할 때 받는 VAT이고 Input Tax은 내가 물건/서비스를 구입할 때 지불하는 VAT이다. 신고서의 항목 12-16은 Output Tax을 구하는 과정이고, 항목 17-21은 Input Tax을 구하는 과정이다. 그리고 항목22-26은 Net VAT을 구하는 과정이다.

A. Output VAT 구하기(12-16)

- 12A. Sales/Receipts-Private: 한 달 동안 소비자 또는 다른 민간업체에 상품이나 서비스를 판매하고받은 매출액 합계이다. 즉, 관공서 등에 판매한 매출액(13A)을 제외한 나머지이다. Schedule 1에 구체적인 세목으로 나누어 기재한다. 이때 매출액합계에 Output Tax는 포함시키지 않는다.

- 12B. Output Tax-Private : 12A에 12%를 곱해 Output Tax를 구한다.

- 13A. Sales-Government :한 달 동안 중앙정부나 지방정부에 납품한 상품대금 합계이다. 이때 매출액 합계에 Output Tax는 포함시키지 않는다.

- 13B. Output Tax-Government : 13A에 10(?)%를 곱해 Output Tax을 구한다. 정부에 대해 부가하는 Output Tax은 일반적인 VAT(12%)보다 작다.

- 14. Zero Rated Sales/Receipts: 수출하는 경우나 세금 면제자에게 판매하는 경우에는 Output Tax 세율이 0%이다. 원래 Output Tax에 상응하는 만큼 대신 세액공제(tax credit)를 받을 수 있다.

- 15. Exempt Sales/Receipts: 가공하지 않은 농축수산물을 판매/수입하는 경우나, 교육서비스 등은 VAT가 면제된다. 손해 본 Output Tax은 대신 비용(cost)으로 처리할 수 있다.

- 16A. Total Sales/Receipts : 12A, 13A, 14 및 15를 더해 총 매출액을 구한다.

- 16B. Total Output Tax : 12B와 13B를 합해 총 Output Tax을 구한다.

B. Input VAT 구하기(17-21)

17A 내지 17F에서는 과거에 발생한 Input Tax을 구한다.

- 17A. Input Tax carried Over from Previous Period : 지난 달의 Input Tax이 Output Tax 보다 클 경우 차감되고 남게 되는데 남은 Input Tax은 이번달(과세기간)에 다시 Input Tax으로 포함된다. 즉 아래 항목 24에서 (overpayment)가 발생한 경우 여기에 적는다.

- 17B. Input Tax Deferred on Capital Goods Exceeding P 1Million from previous period : 전달로부터 이월된 자본재에 대한 Input Tax이다. 한 달 동안 구매한 자본재가 P1M를 넘을 경우 전체 Input Tax 중 일부만 그 달에 쓰이고 나머지는 내구년한(또는 60개월 중 작은 기간) 동안 분산되어 차감된다. 자세한 내용은 이하 Scheldue 3-B)에 대한 설명을 참조하기 바란다.

- 17C. Transitional Input Tax: 모르겠음.

- 17D. Presumptive Input Tax: 모르겠음.

- 17E. Others

18A 내지 18P에서는 이번 달(과세기간) 동안에 발생한 Input Tax을 계산한다.

- 18A. Purchase of Capital Goods not exceeding P1 Million : 한 달 동안 구매한 자본재의 합계가 P1M를 초과하지 않는 경우에는 그 합계를 18A에 기재한다. 그리고 다시 Schedule 2에 세부항목별로 금액을 나누어 적는다.

- 18B. Input Tax : 18A에 12%를 곱해 구한다. 이 Input Tax은 이번달에 모두 Output Tax을 차감하는데 쓰인다.

- 18C. Purchase of Capital Goods exceeding P1 Million : 한 달 동안 구매한 자본재의 합계가 P1M를 초과하는 경우에는 그 합계를 18B에 기재한다. 그리고 다시 Schedule 3-A)에 세부항목별로 금액을 나누어 적는다. 자세한 내용은 이하 Scheldue 3에 대한 설명을 참조하기 바란다.

- 18D. Input Tax : 18C에 12%를 곱해 구한다.

- 18E. Domestic Purchase of Goods other than Capital Goods : 국내에서의 비자본재(또는 소비재)의 구매 합계를 기재한다.

- 18F. Input Tax : 18E에 12%를 곱해 구한다.

- 18G. Importation of Goods other than Capital Goods : 수입한 소비재 대금 합계를 적는다.

- 18H. Input Tax : 18G에 12%를 곱해 구한다.

- 18I. Domstic Purchase of services국내 서비스 구매 합계를 적는다.

- 18J. Input Tax : 18I에 12%를 곱해 구한다.

- 8K. Services rendered by Non-residents : 비거주자로부터 받은 서비스에 대한 대금의 합계를 적는다. 관광비자 소지자도 비거주자에 속한다.

- 18L. Input Tax : 18K에 12%를 곱해 구한다.

- 18M. Purchases Not qualified for Input Tax : 대표적인 예가 Percentage Tax 납부자로부터 구매하는 상품/서비스 대금이다. 그 합계를 적는다. 당연히 Input Tax은 없다.

- 18N. Others

- 18O : 18N에 12%를 곱해 구한다.

- 18P. Total current purchases : 이번달 총 구매 합계이다. 18A, 18C, 18E, 18G, 18I, 18K, 18M 및 18N을 더해 구한다.

- 19. Total available Input Tax : 이번달에 발생한 모든 Input Tax의 합계이다. 17F, 18B, D, F, H, J, L, 및 O를 모두 더한다.

20. 여기서는 상기 19에 포함된 Input Tax 중에서 법률에 의해 제외되는 Input Tax을 구한다.

-20A. Input tax on purchases of capital goods exceeding P1Million deferred for the succeeding period : 18C에서 구한 Input Tax 중 다음달로 넘겨야 하는 부분이다. 자세한 내용은 이하 Scheldue 3-A)에 대한 설명을 참조하기 바란다.

- 20B. Input Tax On sale to Govet. closed to expense : 모르겠음.

- 20C. Input Tax allocable to Exempt Sales : 모르겠음.

- 20D. VAT Refund/TCC claimed : 17A에 포함된 overpayment 중에 이미 VAT Refund/TCC로 인출된 Input Tax은 당연히 제외된다. 자세한 내용은 아래 항목 24에 대한 설명을 참조하자.

- 20E. Others

- 20F. Total : 제외되는 Input Tax의 합계이다. 20A 내지 20E를 모두 더한다.

21. Total allowable Input Tax : 이번달에 차감할 Input Tax의 합계이다. 19에서 21F를 차감해 구한다.

C. Net VAT 구하기(22-26)

- 22. Net VAT payabe : Output Tax 합계와 Input Tax 합계의 차이다. 16B에서 21을 차감함으로써 Net VAT을 구한다.

23. Less: Tax Credits/Payments : 세액공제를 하는 단계이다.

- 23A. Creditable Value-Added Tax Withheld : 법률에 따라 소비자가 Output Tax 중 일부를 판매자(또는 납세자)에게 지불하지 않고 직접 BIR에 납부(withhold & remit)하는 경우가 있다(BIR Form 166 참조). 이 경우 판매자는 실질적으로 Output Tax을 납부한 것이므로 그 만큼 세액공제 해준다.

- 23B. Advance Payments for Sugar and Flour Indusrties : 설탕이나 밀가루의 경우에는 판매업자가 소비자에게 아직 판매하지 않았더라도 미리 Output Tax을 납부하여야 한다. 따라서 미리 납부한 만큼 공제한다.

- 23C. VAT withheld on Sales to Government : 정부, 관공서, 국공영기업에 납품하는 경우 정부 등이 Output Tax을 직접 납부한다(원천징수한다).

- 23D. VAT paid in return previously filed, if this is an amended return : 만약 세금 중 일부를 누락하고 세금신고한 경우에는 정정신고서를 제출할 수 있다. 이때는 먼저 낸 세금은 빼고 누락된 부분만 납부하면 된다.

- 23E. Advance Payments made(BIR Form 0605) : 모르겠음.

- 23F. Others

- 23G. Total Tax Credits/Payments : 세액공제 합계이다. 23A 내지 23F를 더해 구한다.

24. Tax still Payable/(Overpayment) : 세액공제 후 남는 Output Tax이다. 22으로부터 22G를 빼서 구한다. 만약 이때 잔액이 음수(-)이면 초과납부(overpayment)된 것이다. 첨부한 보기에서도 88,000페소가 초과되었다. 이때는 액수 앞에 "마이너스(-)"를 붙이는 것이 아니고 "괄호( )"로서 표시한다.

이 초과납부액을 되찾는 방법은 3가지가 있다.

- 다음달 VAT 신고서에 Input Tax으로 다시 포함시키는 것이다(항목 17A).

- 세액공제 증명서(Tax Credit Certificate, TCC)를 발급받아 두었다가 나중에 공제

받을 수 있다(BIR Form 1914).

- 돈으로 환불(Refund) 청구를 할 수 있다(BIR Form 1914).

25. Penalties : 연체하면 과태료 등을 더 내야한다. 구체적인 내용은 다음과 같다.

- 25A. Surcharge : 일단 체납액의 25%의 추가분이 발생하고(악의의 경우 50%),

- 25B. Interest : 체납액의 연 20%이자를 부담하는데 액수는 일단위로 계산된다.

- 25 C. Comporomise : 형사처벌을 하지않는 대신 부과하는 벌금이다.

26. Total Amount Payable/(Overpayment) : 24와 25을 더하면 신고할 최종적인 VAT가 산출된다.

<참조>

- 자본재(capital goods)란 사업운영에 필요한 장비, 건물 등 내구재를 의미한다. 가령 차량정비소의 경우 정비소 건물, 트럭, 검사장비, 수리장비 등을 예로 들수 있다.

- 소비재(consumer goods)란 자본재와 대비되는 것으로 소모성 재화를 의미한다. 가령 차량정비소의 경우 타이어, 오일, 필터 기타 부품 등이 예가 될 수 있다.

- 이 밖에 부가가치세에 자세한 내용은 자료실에 올려 놓은 "Revenue Regulation No. 16-2005"를 참조하기 바란다.

D. Scheldue 작성

이번 달 구입한 자본재 합계(18C : P1,100,000)가 P1M를 초과하였다. 따라서 그 구체적인 항목은 Schedule 2 대신 Schedule 3-A)에 기재한다.

1) Schedule 3-A)

이번달엔 Vehicle Lift를 구입하였다. 그 가격은 P400,000(C)이므로 Input Tax(D:12%)은 P48,000이다. Vehicle Lift의 가동수명(E: Estimated Life)은 120개월이다. 가동수명이 한계치 60개월을 초과하므로 허용수명(F: Recognized Life)은 60개월이 된다. Input Tax(P48,000)을 허용수명(60개월)으로 나누면 P800페소가 나온다. 이 P800만 이번달 Input Tax(G)에 포함되고 나머지 P47,200(H)는 다음달부터 매달 P800페소씩 차감된다.

2) Schedule 3-B)

지난 5월에도 P1M를 초과하는 자본재인 Tow Truck을 구입하였다. 따라서 Vehicle Lift와 같은 방법으로 그 Input Tax을 다달이 분산해서 차감해 오고 있다. 최초 Input Tax은 P504,000(P4,200,000*12%)이었는데 지난 6월과 7월에 각각 월 Input Tax P8,400(P504,000/60month)를 차감하고 나머지(D)가 P487,200이다. 이번달치 Input Tax(G) 또한 P8,400(D/F=487,200/58)이다.

MRPI (2013/09/21)